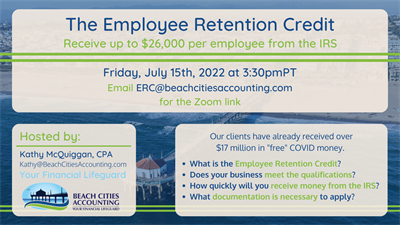

Employee Retention Credit Webinar - Find out if your business is eligible! If you qualify, the IRS will send you money!

Your business may be eligible for up to $26K per employee through the Employee Retention Credit. On average, the IRS has sent our non-restaurant clients $150,000 and our restaurant clients $260,000. There are many ways to qualify. On average, our clients are paying less than 10% of their ERC refund. We do not charge based on the refund amount. We charge based on the complexity of the calculation.

Join us on the webinar to learn more!

Date and Time

Friday Jul 15, 2022

3:30 PM - 4:30 PM PDT

July 15th, 2022 at 3:30pm PST

Email ERC@beachcitiesaccounting.com for the Zoom link.

Location

Email ERC@beachcitiesaccounting.com for the Zoom link.

Fees/Admission

Free!

Contact Information

Kathy McQuiggan

Send Email